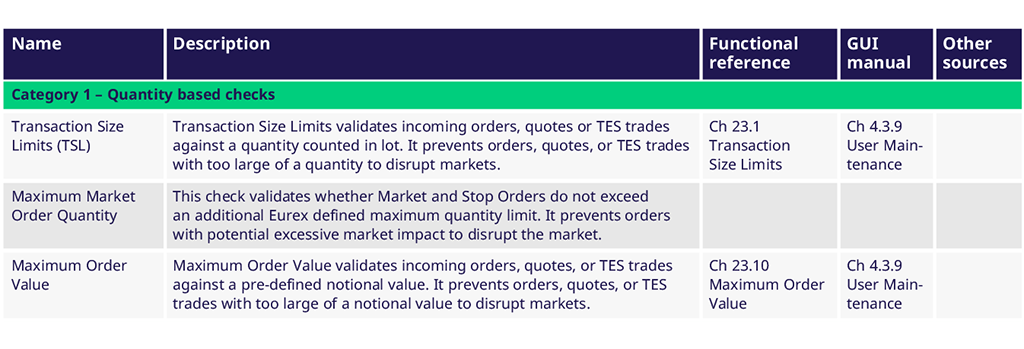

Eurex Trading Safeguards

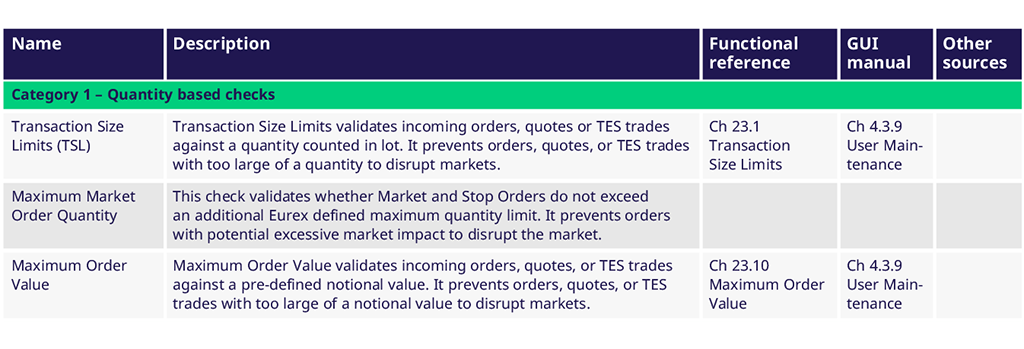

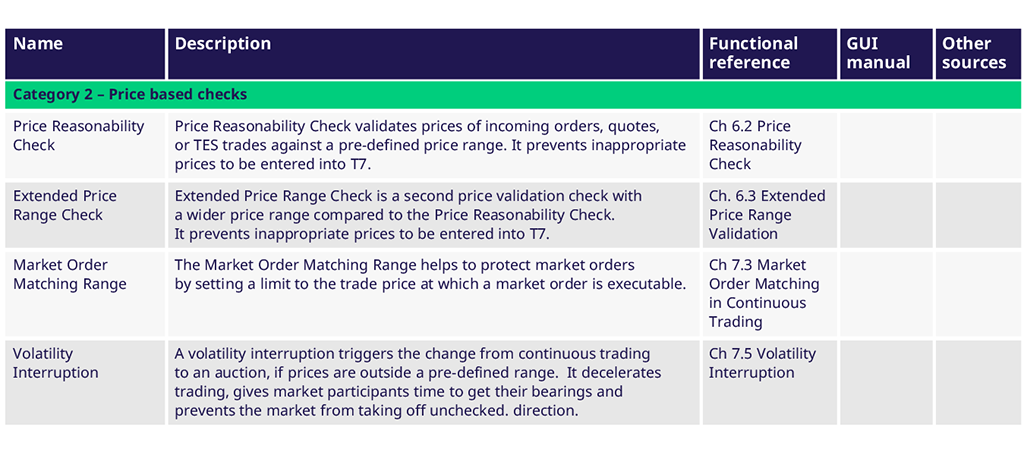

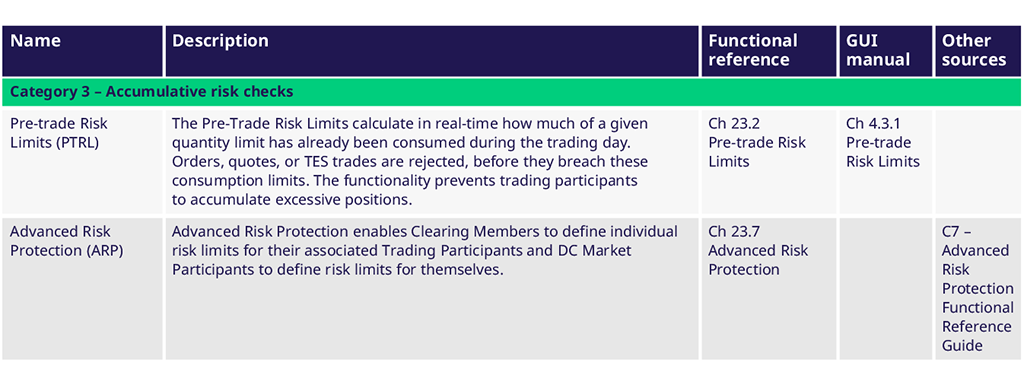

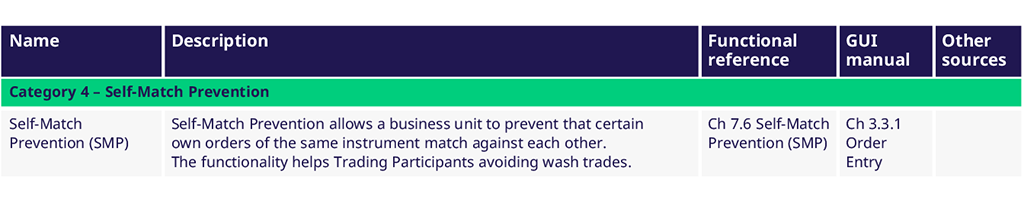

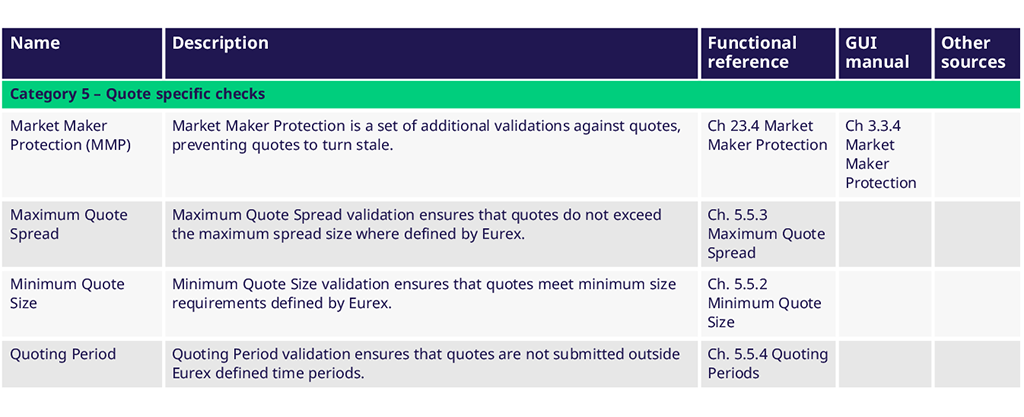

Eurex offers a wide range of integrated risk management functionalities. These safeguards not only serve Eurex to ensure orderly trading while operating safe markets but also enable customers to manage their own risk more efficiently. The overview below provides an wholistic view on relevant trading safeguards for Trading Participants and Clearing Members.

Stressed Market Conditions

There are two types of Stressed Market Conditions on Eurex market, the SMC_Auto under MiFID2 requirements, which is detected automatically by the T7 trading system with pre-defined parameters and the SMC_Fast which is set manually by Eurex for products and situations that are not covered by the SMC_Auto.

All changes of SMC are communicated to the market through the Production Newsboard.

SMC_Auto

SMC_Auto is implemented according to the MiFID2 regulation for Equity Index Futures, Equity and ETF Futures that will be triggered if one of the following criteria is met:

- End of a volatility interruption

- Simultaneous significant short-term change of price and volume during a predefined time interval

SMC_Auto is set to 10 minutes, after which the product state will return to normal unless another SMC is triggered. Respective options defined as related products of the above-mentioned futures will be also switched to SMC along with the futures.

SMC_Fast

Eurex will set products to SMC_Fast at its own discretion if certain criteria are fulfilled. However, fulfilment of the criteria does not automatically lead to the switch of products into Fast as the decision will be made according to current market situation.

Decision criteria include but are not limited to the following:

- Significant movement of the underlying index/ share

- Economic releases, industrial news, company news or other information which will have large impact on the market, specific industry or specific products

- Significant movement of the volatility index e.g. VSTOXX®, VDAX® as indication for major equity index products and also market sentiment

- General orderbook situation

- Other criteria which may have influence on market movements

General process of setting products to Fast Market:

- It can be triggered both by Eurex or upon request by market participants.

- Eurex monitors movements in the market and products. Products that are detected to expect higher volatility, will be set manually to Fast Market and switched back to normal market condition if deemed necessary.

- The same evaluation and decision process will take place if there is any request from market participants.

Connection to EOBI Market Data messages

Members also have the chance to capture the Eurex trading phase changes by connecting to EOBI Market Data messages. The corresponding EOBI message code TAG 2705 (MarketCondition) and 2447 (FastMarketIndicator) can be captured for changes into Fast or Stressed Market Condition. More information can be found in the EOBI Manual.